What the delay means

Large non-EU companies that operate in EU markets will not need to comply with CSRD reporting requirements until after October 2027. These requirements will be set out in the European Sustainability Reporting Standards (ESRS) for third-country undertakings, which the Commission has now deprioritised.

This delay gives affected companies – particularly multinationals from the United States, the United Kingdom, and Asia – more time to prepare for compliance. It does not change the long-term direction of EU sustainability regulation. Companies will still need to disclose information on social and environmental issues as part of their environmental, social, and governance (ESG) disclosures, including climate risks, human rights, and resource use, once the new delegated acts are adopted.

In short, the EU remains committed to corporate sustainability and transparency, but wants to give businesses more time to adapt and align with frameworks such as the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy.

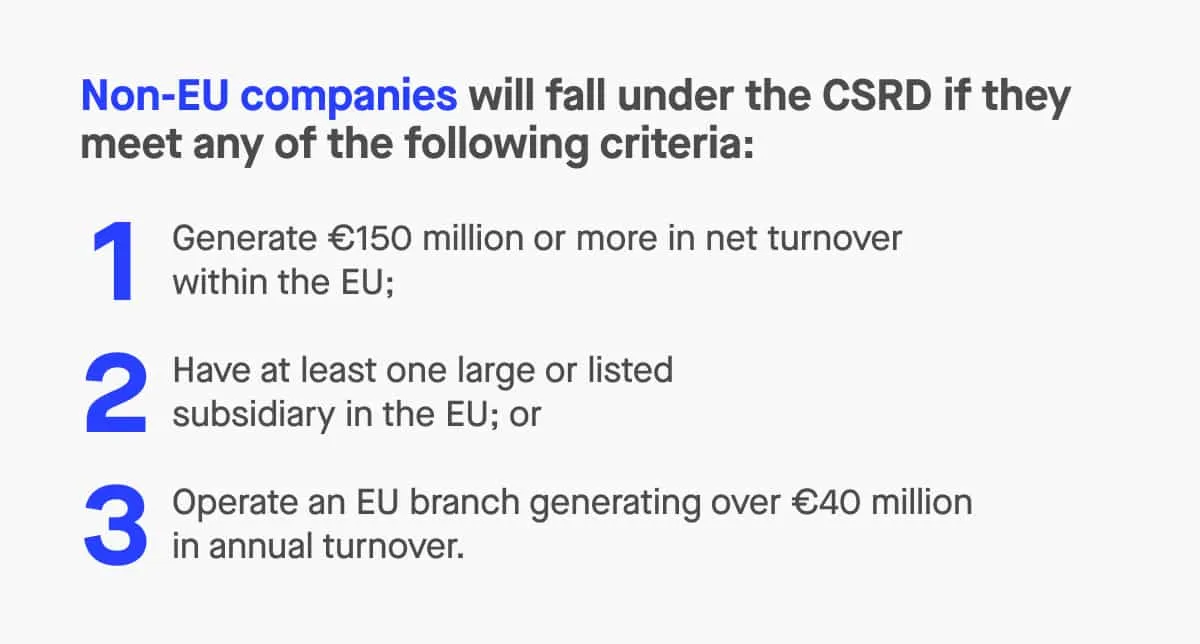

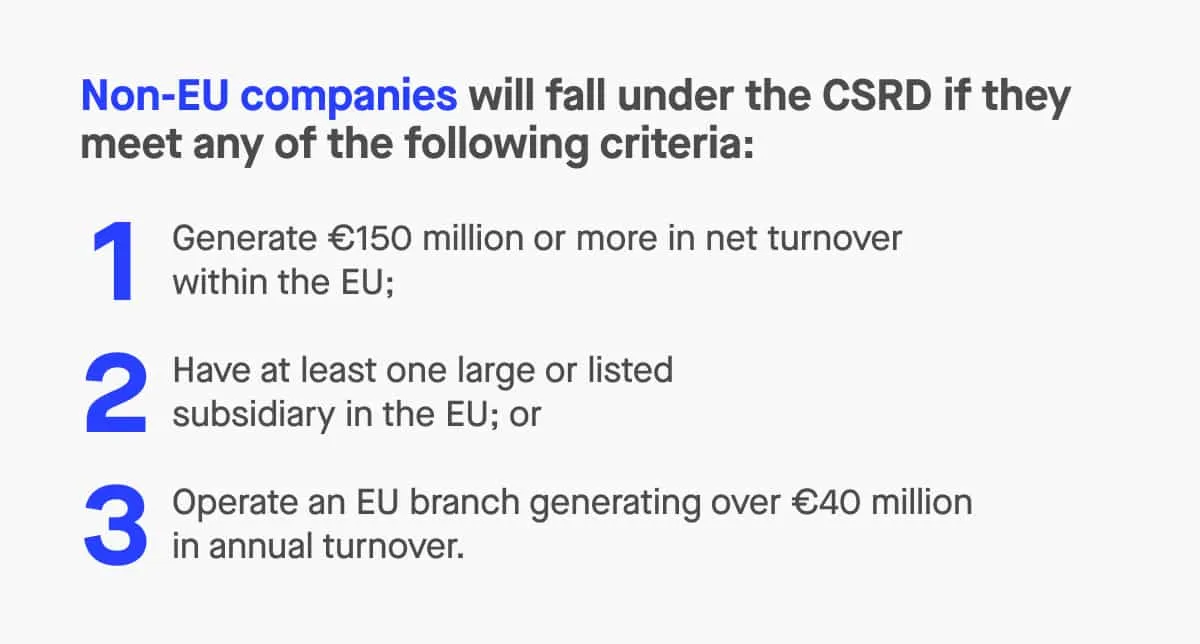

Which companies are affected

The delay only applies to the non-EU reporting standards. All other CSRD obligations for EU-based companies and listed entities remain in effect. The CSRD applies to companies above a certain size, as mandated by EU law.

Additionally, all companies listed on EU regulated markets are also required to comply with the CSRD, regardless of size.

When implemented, these companies, including listed companies, will need to prepare CSRD reports that meet the same assurance and transparency standards as EU companies. Reports must cover the entire value chain, including environmental issues such as resource use, pollution, and circular economy efforts, as well as social and human rights practices and governance policies.

Although the Omnibus package currently being debated could raise the employee threshold from 250 to 1,000 and simplify reporting, most large companies, medium sized enterprises, and financial market participants will still be required to disclose their sustainability performance once the new delegated acts are adopted.

What remains in force

While the delegated acts for non-EU undertakings are delayed, the core CSRD obligations for large companies and listed entities in the EU are already live.

The Corporate Sustainability Reporting Directive, adopted by the European Parliament and the Council in 2022, builds on the Non-Financial Reporting Directive (NFRD). It requires detailed sustainability information in management reports and introduces double materiality – meaning companies must assess both how sustainability issues affect their business and how their activities impact people and the environment.

The CSRD applies in phases:

- 2024: The first companies required to report under the CSRD are those already subject to the NFRD.

- 2025: Other large EU companies not previously covered join the scope.

- 2026: Listed SMEs (excluding micro enterprises) start reporting, with an optional one-year delay.

- 2028: Large non-EU companies meeting the thresholds will report once the new ESRS standards are adopted.

These rules are now part of national law in most EU member states and form the cornerstone of the EU’s sustainable finance framework.

How in-scope companies can prepare

Even with the delay, companies in scope should not pause their reporting process. The European Commission’s timeline shift gives firms a valuable opportunity to establish internal structures and processes that can withstand scrutiny under CSRD compliance and independent assurance services providers. Each company must adapt its reporting processes to meet the new requirements introduced by the CSRD.

Preparation should focus on several key areas. Adopting a strategic approach to sustainability reporting can help turn compliance into a competitive advantage:

- Conduct a double materiality assessment

Under the Corporate Sustainability Reporting Directive, companies must evaluate both how sustainability issues affect financial performance and how their operations impact people and the environment. This exercise helps firms focus on material topics rather than attempting to disclose every metric available.

- Strengthen governance and oversight

CSRD reports require evidence of board-level engagement with sustainability issues. Large companies should assign clear accountability for ESG data management and align sustainability governance with risk and finance functions.

- Improve data collection and quality

Sustainability reporting requires accurate, auditable data across the entire value chain. Firms should begin mapping where data resides, especially across subsidiaries, suppliers, and business partners, and ensure consistent formats for collection and validation. Engaging with stakeholders, including clients and investors, is essential to facilitate data sharing and improve reporting quality.

- Integrate global frameworks

To avoid duplication, companies should align CSRD metrics with frameworks such as the ISSB standards, the Sustainable Finance Disclosure Regulation, and the EU Taxonomy. A consistent reporting structure improves comparability and reduces the risk of non-compliance across jurisdictions.

- Prepare for assuranceFrom 2026, CSRD reports will require limited assurance by independent assurance service providers, transitioning to reasonable assurance in later years. Building internal controls, documentation trails, and verification processes now will make future external audits smoother.

In practical terms, this means investing in systems that link sustainability data directly to financial data, enabling cross-department collaboration. For firms with complex international operations, readiness will also depend on training teams across member states and subsidiaries in CSRD compliance and national law transpositions.