Sustainability has become a cornerstone of modern business strategies, especially for organizations with global operations. For U.S. businesses engaging with European markets, understanding the nuances of the Sustainable Finance Disclosure Regulation (SFDR) is essential. As a critical pillar of the European Union’s Sustainable Finance Agenda, the SFDR shapes how businesses and financial entities disclose their sustainability-related activities.

Understanding the investment objective is crucial for aligning with SFDR requirements and managing sustainability risks.

The European Supervisory Authorities have provided important updates on regulatory technical standards (RTS) that help companies understand and implement SFDR disclosure requirements.

This article explores the SFDR’s key components, its scope, effects on U.S. businesses, and how aligning with it can unlock opportunities in sustainable finance.

What is the SFDR?

The Sustainable Finance Disclosure Regulation (SFDR) is a European regulation designed to improve transparency in sustainable investment products within the financial sector. It aims to prevent greenwashing and provide stakeholders with consistent, reliable information regarding environmental, social, and governance (ESG) practices.

What is the history of the legislation?

Introduced by the European Commission as part of its 2018 Sustainable Finance Action Plan, the SFDR complements other regulatory measures like the EU Taxonomy Regulation and the Low Carbon Benchmarks Regulation. Together, these initiatives promote sustainability and align with broader goals, such as achieving climate neutrality by 2050 under the European Green Deal.

The SFDR became effective in March 2021, establishing disclosure requirements at both the entity and product levels. Financial actors are required to disclose how they integrate sustainability risks into their decision-making processes and the potential adverse sustainability impacts of their investments. Achieving the investment objective is a key consideration for financial actors under the SFDR, as they must balance sustainability risks with their investment goals.

What is the scope of the SFDR?

The SFDR applies to a broad range of financial market participants (FMPs) and financial advisers, including investment advisers, operating within the EU. Investment advisers play a crucial role in disclosing sustainability risks and principal adverse impacts, helping investors make informed decisions about sustainable investment products.

These include:

- Asset managers: Responsible for managing investment funds and portfolios, they must disclose how they integrate sustainability risks into their investment processes.

- Investment firms: These entities, which provide investment services and advice, need to report on their sustainability practices and the principal adverse impacts of their financial products.

- Insurance companies: Offering various insurance products, these companies must disclose how they consider sustainability risks in their underwriting and investment activities.

- Banks: Particularly those involved in portfolio management, banks are required to provide transparency on their sustainability risk assessments.

- Venture capital funds: These funds, which invest in early-stage companies, must disclose their approach to sustainability risks and the potential adverse impacts of their investments.

- Financial advisers: Advisers who guide clients on investment decisions must ensure their advice incorporates sustainability risks and aligns with SFDR requirements.

- Pension funds: Managing retirement savings, these funds need to disclose how they integrate sustainability factors into their investment strategies.

The SFDR also extends its reach to non-EU entities that market or appear to market financial products to EU clients. This means that organizations outside the EU, including those in the U.S., must comply with the SFDR’s disclosure requirements if they offer financial products to EU investors. This broad applicability ensures that sustainability practices are transparent and consistent across the global financial market.

What is the classification of financial products?

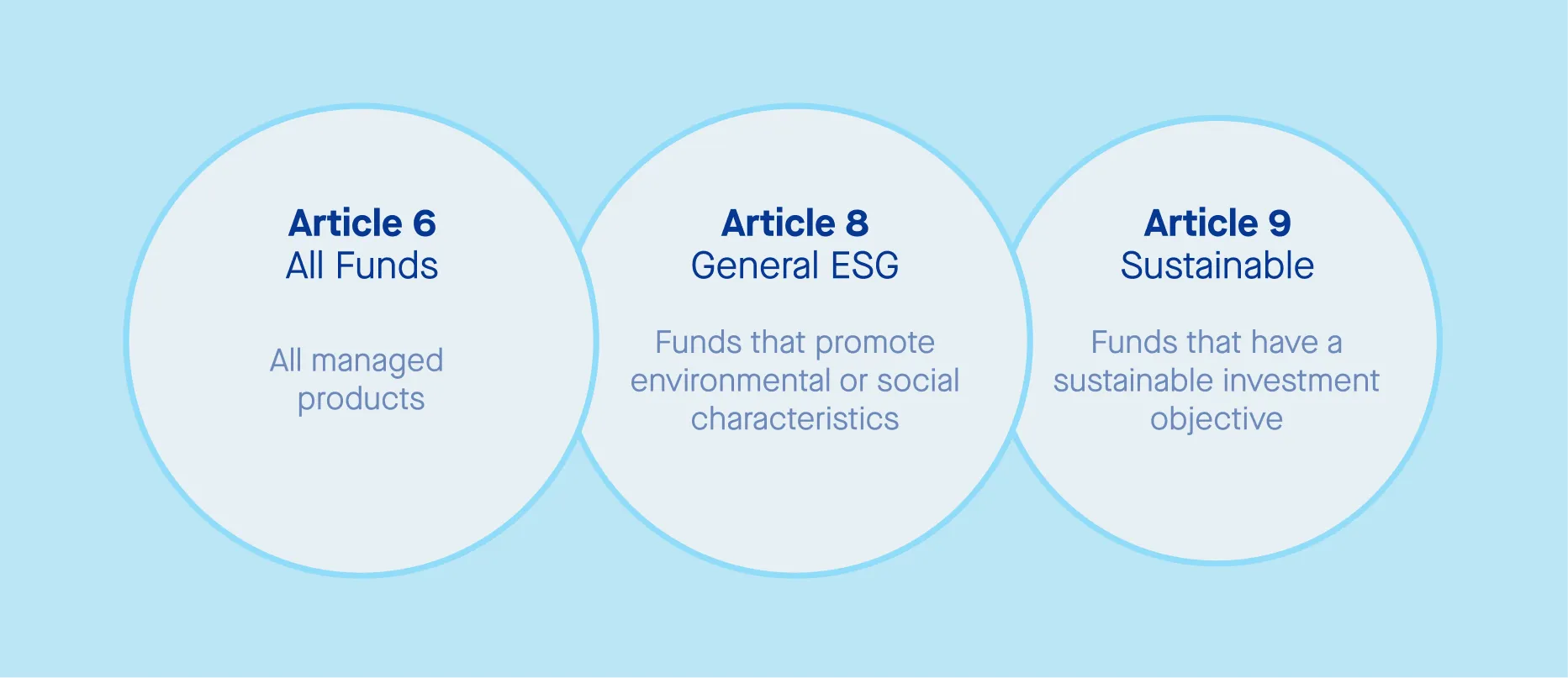

The SFDR categorizes financial products into three classifications based on their approach to sustainability:

Article 6 Products: Mainstream financial products that integrate sustainability risks without specifically promoting ESG objectives.

Article 8 Products: Financial products promoting environmental or social characteristics, provided they adhere to good governance practices.

Article 9 Products: Financial products with sustainable investment as their core objective, requiring detailed alignment with ESG indicators to meet SFDR standards. These products are designed with a sustainable investment objective, necessitating careful consideration of ESG factors.

This broad scope underscores the SFDR’s ambition to ensure transparency across the financial ecosystem, from portfolio managers to institutional investors.

What is the SFDR Timeline?

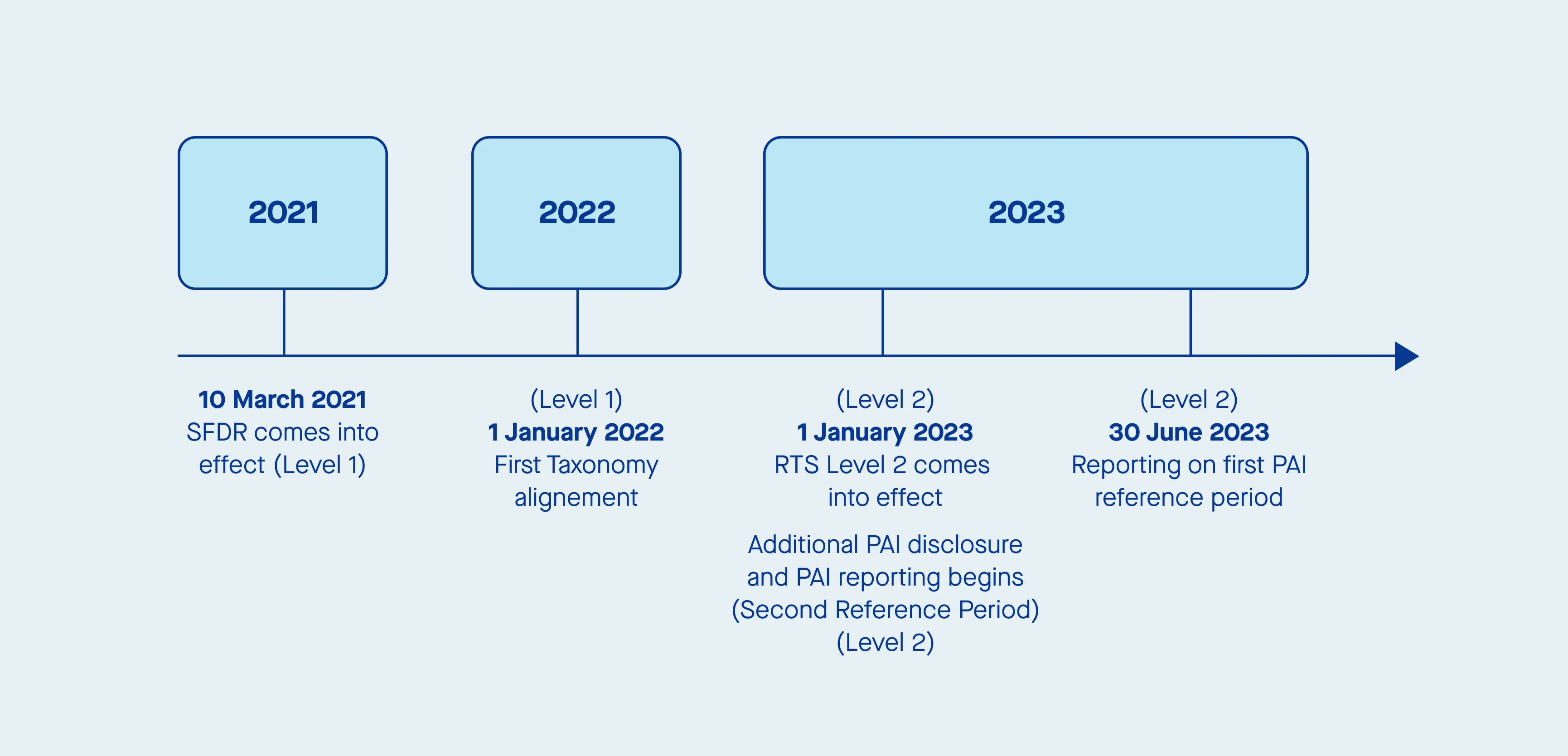

The implementation of the SFDR follows a phased timeline, with key milestones that financial market participants need to be aware of:

- 10 March 2021: This date marked the introduction of Level 1 disclosures. Financial market participants were required to start disclosing information about their sustainability practices and the sustainability risks associated with their financial products. This initial phase set the foundation for greater transparency in sustainable finance.

- 1 January 2022: Originally, Level 2 disclosures were scheduled to come into effect on this date. However, the implementation was delayed to allow financial market participants more time to prepare for the more detailed reporting requirements.

- 1 January 2023: Level 2 disclosures officially came into effect. These disclosures require financial market participants to provide more comprehensive information on their sustainability risks and principal adverse impacts. This includes detailed reporting on how these risks are integrated into their investment processes and the specific adverse impacts their investments may have on sustainability factors.

Understanding and adhering to this timeline is crucial for financial market participants to ensure compliance and avoid potential penalties.

How Does the SFDR affect U.S. Organizations?

For U.S.-based organizations interacting with EU markets, the SFDR presents both challenges and opportunities.

Adopting sustainable investment strategies in line with SFDR guidelines can help U.S. businesses align with EU standards and gain a competitive edge.

1. Increased disclosure requirements

To access EU capital or serve EU-based clients, U.S. businesses must comply with the SFDR’s detailed disclosure mandates. Fund managers, for instance, must classify their financial products under Articles 6, 8, or 9 and adhere to corresponding reporting standards. These classifications determine the depth and complexity of required disclosures, ranging from sustainability risks to alignment with the EU Taxonomy.

2. Alignment with ESG goals

U.S. firms must integrate sustainability considerations into their operations to meet SFDR requirements. This involves addressing principle adverse impacts (PAIs) on ESG metrics such as greenhouse gas emissions, biodiversity, and labor rights. Firms are expected to provide robust evidence of their sustainability initiatives, aligning with EU standards to avoid non-compliance penalties.

3. Competitive advantage in financial markets

Adopting SFDR-compliant practices can position U.S. businesses as leaders in sustainability, appealing to environmentally conscious investors and customers. Firms that align their strategies with SFDR guidelines may gain a competitive edge in attracting EU capital and enhancing their brand reputation.

4. Operational complexity

The SFDR’s stringent requirements necessitate significant operational changes. U.S. businesses must establish systems to collect, verify, and report ESG data, often requiring collaboration with third-party verification services and investment in new technologies.

The role of sustainable finance in strategic planning

Sustainable finance lies at the core of the SFDR. By channeling investments into environmentally and socially responsible projects, companies can align their goals with broader sustainability targets.

The Securities and Futures Commission plays a crucial role in overseeing financial activities and ensuring compliance with local laws and regulations, particularly in jurisdictions like Hong Kong.

Why are asset managers key players?

Asset managers play a pivotal role in driving sustainable investing. Their ability to integrate sustainability risks into portfolio management not only mitigates financial risks but also maximizes returns over the long term. Asset managers who prioritize transparency and align with SFDR guidelines can influence global financial markets to adopt sustainable practices.

What about financial advisers?

Financial advisers also have a critical role in guiding clients through the complexities of sustainable investing. By addressing sustainability risks and incorporating them into their recommendations, advisers can help clients align their investments with their values while meeting SFDR requirements.

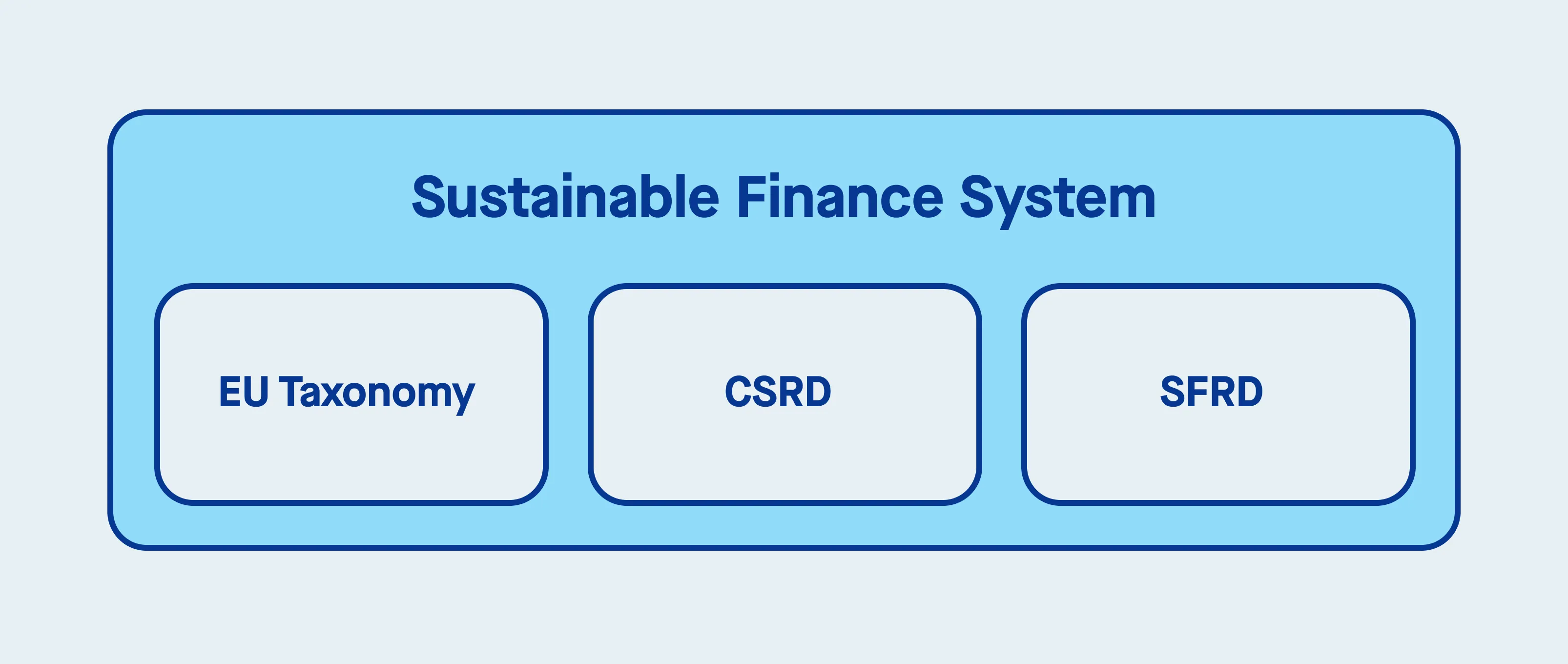

SFDR and EU Taxonomy

The SFDR and the EU Taxonomy are two pillars of the European Union’s strategy to foster sustainable finance. While the SFDR focuses on enhancing transparency through stringent disclosure requirements for financial market participants, the EU Taxonomy provides a detailed classification system for environmentally sustainable economic activities.

How the SFDR uses EU Taxonomy

The SFDR leverages the EU Taxonomy to assess and disclose the environmental sustainability of financial products. Financial market participants are required to report the proportion of their investments that meet the EU Taxonomy’s criteria for environmentally sustainable activities. This is particularly relevant for financial products with sustainable investment objectives, such as those classified under Article 9 of the SFDR.

By utilizing the EU Taxonomy, the SFDR aims to offer investors a clear and reliable understanding of the environmental impact of their investments. This transparency is crucial in combating greenwashing, ensuring that financial market participants provide accurate and honest information about the sustainability of their products. Consequently, this builds trust in the financial markets and encourages the development of genuinely sustainable investment products.

In essence, the integration of the EU Taxonomy within the SFDR framework not only enhances the credibility of sustainability claims but also drives the growth of sustainable finance by setting a high standard for environmental disclosures.

How can US organizations prepare for the SFDR?

To comply with the SFDR, US businesses must adopt a forward-thinking approach that integrates sustainability into their operations and disclosures. This not only fulfills regulatory requirements but also positions organizations for success in an increasingly ESG-focused market.

1. Build a robust ESG data framework

Effective SFDR compliance depends on the ability to collect, manage, and report accurate ESG data. Companies should establish systems to track key metrics such as carbon emissions, biodiversity impacts, and governance practices.

Advanced data management tools and software platforms that align with global reporting frameworks, like GRI or SASB, can streamline this process, ensuring consistency and reducing manual errors.

2. Evaluate sustainability risks and principal adverse impacts

A key requirement of the SFDR is assessing sustainability risks and the principal adverse impacts (PAIs) of investments. This involves analyzing how activities affect ESG metrics such as emissions, resource use, and social equity. By addressing these impacts early, businesses can mitigate compliance risks and align their strategies with sustainability goals.

3. Create transparent and accessible reporting systems

Transparency is at the heart of SFDR compliance. Companies must implement clear reporting mechanisms for sustainability-related information, publishing both entity-level and product-level disclosures online. Using standardized templates enhances comparability and builds trust with stakeholders.

4. Align with international standards

Harmonizing ESG disclosures with global frameworks like TCFD or SASB not only meets SFDR requirements but also ensures consistency across jurisdictions. This alignment demonstrates a company’s commitment to high standards and prepares it for future global regulations.

5. Train teams and engage stakeholders

Internal education on SFDR obligations is essential for compliance. Businesses should ensure cross-departmental collaboration between legal, compliance, and sustainability teams. Externally, engaging with investors and other stakeholders on sustainability performance strengthens relationships and enhances credibility.

Regular feedback and audits can further refine ESG practices and address market expectations.

How an ESG reporting platform can help

A reporting platform can be an invaluable tool in simplifying and streamlining SFDR compliance. By providing an automated, centralized system for ESG data collection and reporting, these platforms ensure that data is accurate, consistent, and aligned with global frameworks.

They also help businesses evaluate sustainability risks and principal adverse impacts, create transparent and standardized reports, and adapt to emerging global regulations with ease. With the right platform in place, businesses can reduce manual errors, improve efficiency, and demonstrate a clear commitment to sustainability, positioning themselves as leaders in the evolving landscape of sustainable finance.

Turning SFDR compliance into a competitive edge

Meeting SFDR requirements offers businesses opportunities to drive growth and leadership in sustainable investing:

Attract EU capital: Compliance enhances appeal to sustainability-focused investors.

Reinforce reputation: Transparent ESG practices build stakeholder trust and market differentiation.

Promote resilience: Strong sustainability practices future-proof businesses against emerging global regulations.

Foster innovation: Compliance inspires new solutions to manage sustainability challenges and unlock opportunities.

Looking ahead: The evolving landscape of ESG regulation

The SFDR is reshaping how financial markets address sustainability, offering a unique chance for US businesses to lead in this transformation. By investing in compliance today, organizations can enhance their resilience, foster innovation, and strengthen their position in the competitive global market.

SFDR Glossary

Carbon emissions

Carbon emissions are the release of carbon dioxide (CO2) and other greenhouse gases into the atmosphere, typically due to activities such as energy production, transportation, manufacturing, and other industrial processes. Financial market participants are required to assess how their investments contribute to or mitigate carbon emissions under the SFDR framework.

Principal Adverse Sustainability Impacts (PAIs)

Principal Adverse Sustainability Impacts are the negative effects that an organization’s activities, investments, or services may have on environmental, social, and governance (ESG) factors. Under the SFDR, financial actors are required to assess and disclose the principal adverse impacts of their investments or services, helping investors understand the potential negative consequences of their choices.

Pre-contractual disclosures

Pre-contractual disclosures are the sustainability-related details that financial market participants must provide to investors before an investment contract is entered into. These disclosures include information on how sustainability risks are considered and how principal adverse impacts may affect the financial product or service.

Risk considerations

Risk considerations in the context of the SFDR involve evaluating sustainability-related risks—such as those related to climate change, environmental degradation, or social issues—when making investment or insurance decisions. These considerations are vital for understanding how such risks might affect future financial performance and investment returns.

Sustainability factors

Sustainability factors are a broad set of criteria that include environmental, social, and governance (ESG) elements. These factors assess a company’s or investment’s performance in areas such as human rights, environmental protection, and ethical governance practices, all of which can influence both financial returns and broader societal impact.

Sustainability risks

Sustainability risks refer to the potential for negative financial impacts resulting from ESG factors, such as the effects of climate change, natural resource depletion, or poor labor practices. Under the SFDR, financial actors are required to incorporate sustainability risks into their investment and insurance strategies to mitigate potential losses and avoid long-term harm.

Sustainable economy

A sustainable economy refers to an economic system that promotes long-term ecological balance by integrating sustainable practices across industries. It emphasizes reducing environmental harm, fostering social equity, and supporting ethical governance to ensure the well-being of both present and future generations.

Sustainable investment

Sustainable investment refers to investments in activities or assets that contribute positively to environmental, social, and governance (ESG) objectives. Under the SFDR, investments are considered sustainable when they contribute to a long-term positive impact on society and the environment, in line with the EU’s sustainability goals.

EU Sustainable Finance

EU Sustainable Finance encompasses a range of regulatory frameworks, initiatives, and policies implemented by the European Union to promote environmentally and socially responsible investments. These efforts aim to facilitate the transition toward a sustainable economy by integrating ESG factors into financial decision-making.